It’s difficult to imagine a world without imported goods. Many of us wake in the morning on an imported bed, drink imported coffee and drive to work in an imported car. International trade is foundational to our everyday lives.

As a business owner, contributing to the global market is an exciting idea, yet exporting isn’t as simple as sending a shipment over the border. Governments worldwide implement policies and rules that influence global trade, such as tariffs. Also known as duties, tariffs are the fees levied on goods transported from one country to another.

Tariffs are established to help protect the domestic market, both directly and indirectly.

For example, an international company and a British Columbian (B.C.) business might sell clay coffee mugs for $30 a piece. The international company must pay a 10% tariff when importing their mugs to Canadian markets, increasing the price to $33. Unimpacted by tariffs, the B.C. mugs remain at $30.

The coffee mug company in B.C. benefits from this tariff, as it helps make their product more competitive and consumers might be more likely to purchase their mugs.

That said, when the tables are turned, tariffs can become a challenge in the exporting process. If the B.C. company exports to a country that imposes tariffs on Canadian coffee mugs, then the price of their product increases. This can make it more difficult to compete in the international market.

Understanding Tariffs

Just as goods and services come in many shapes and sizes, there are a range of different types of tariffs to be aware of.

The example above is an ad valorem tariff, a Latin term translating to ‘according to value’. This type of tariff is calculated as a percentage of the item’s overall cost (10% in the example above).

Specific tariffs, on the other hand, are fixed price, meaning that regardless of the value of the imported good or service, the tariff remains the same. In the scenario above, Canada might place a $5 tariff on all imported coffee mugs, bringing the imported mug to $35.

Countries may also impose export quotas on specific goods or services to further protect their domestic market. For example, if Canada began exporting too many coffee mugs, the federal government may limit the number of mugs that can be sold internationally to ensure Canadians aren’t faced with a coffee mug shortage.

Some goods and services also have a surcharge or surtax associated with them, which is an extra tax or duty in addition to the current tariff. Surcharges are designed to further safeguard the domestic market.

Types of Trade Agreements

Needless to say, tariffs have their benefits, but they can complicate international exporting processes.

Around the world, governments form trade agreements that can reduce or remove tariffs and help streamline and simplify trade.

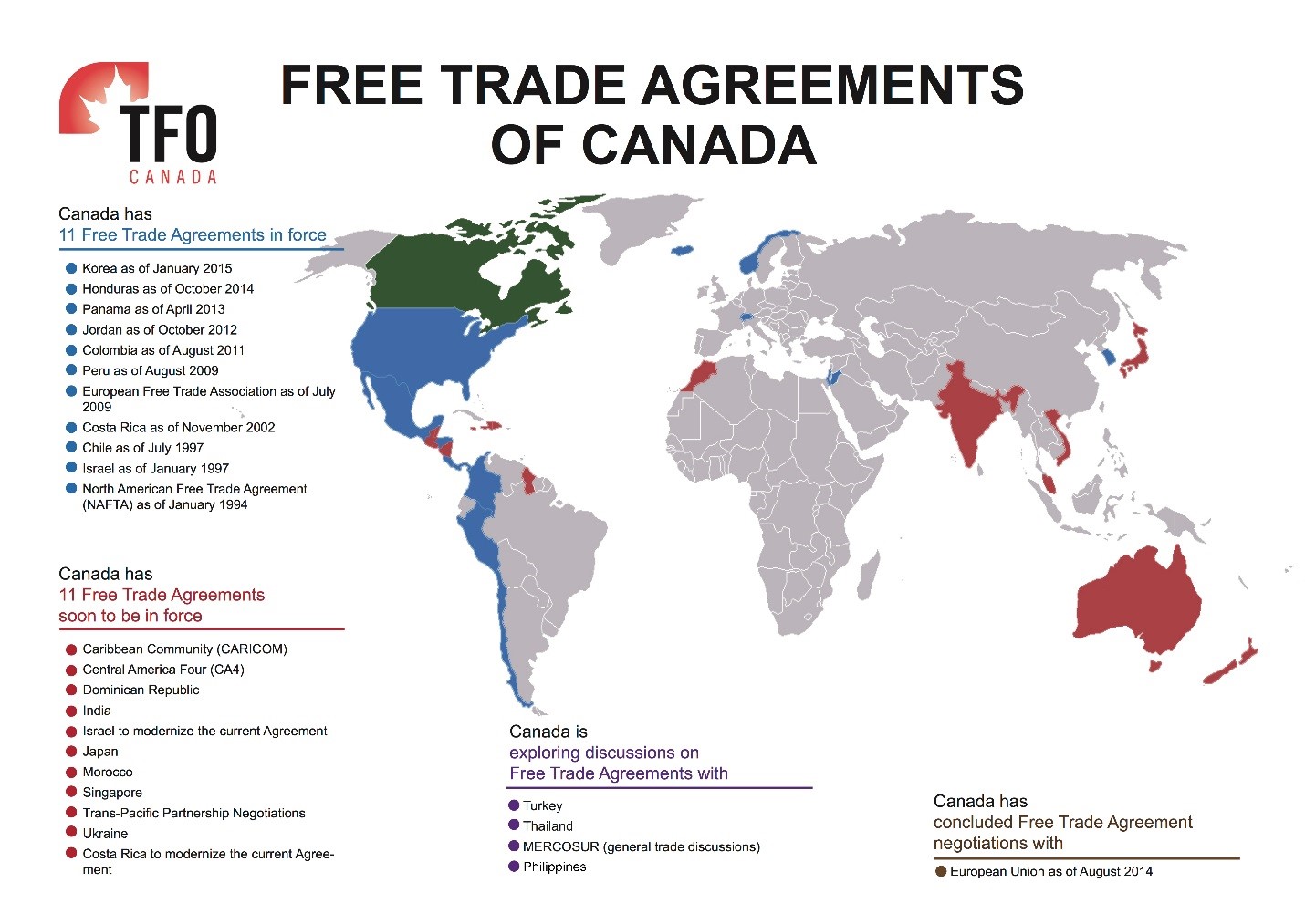

Canada participates in a range of agreements with other countries worldwide:

Plurilateral and multilateral agreements are made between a small number of countries who have a shared interest in a good or service. For example, Canada and 22 other countries are part of the Trade in Services Agreement, designed to improve market access telecommunications, express delivery and many other services.

Free trade agreements greatly reduce or remove tariffs and other trade barriers for participating countries. Free trade agreements simplify access to a wider range of export and international investment opportunities for Canadian businesses.

Navigating Tariffs in Your Business

As you begin to develop your export plan, there are a few steps you can take to help navigate tariffs in international trade:

1. Leverage Canada’s Free Trade Agreements

Through researching free trade agreements, you can learn more about how to export to participating countries without facing tariffs or duties. Canada currently participates in 15 free trade agreements with 51 different countries, opening the market to 1.5 billion consumers worldwide. For example:

- Comprehensive Economic Trade Agreement (CETA) grants Canadian businesses preferential access to market opportunities in the European Union.

- Canada-United States-Mexico Agreement (CUSMA) creates the largest free trade region in the world.

In addition to considering how free trade agreements help to reduce your costs as an exporter, you may be able to source key supplies for your business from markets that participate in a free trade agreement with Canada, reducing your operating costs.

2. Use the Canada Tariff Finder

The Canada Tariff Finder is designed to help businesses understand the tariffs that apply to their specific goods and services. Simply input the importing and exporting country and search keywords pertaining to your goods or service to take the guesswork out of estimating tariffs.

3. Explore Domestic Suppliers

When sourcing supplies for your business, consider how tariffs on imported goods might be increasing your operational fees. By forming relationships with local businesses, you may be able to purchase supplies at a lower price.

If your supplies can’t be sourced locally, try to make free trade agreements work for your business. You may be able to purchase the items you need from markets that participate in a free trade agreement with Canada, avoiding the increased prices associated with other imported products.

Get Support Today

Free trade agreements and online tools exist to help streamline and simplify international trade. Still, the process of understanding how tariffs and other trade barriers impact your business can feel overwhelming. Don’t be discouraged – Export Navigator is here to help!

Our experienced team of Export Advisors is available to answer your questions and help you better understand how to take your business beyond B.C. Reach out today to learn more.