Every business owner’s success story is shared by those who have supported them along the way. For Jason Seed, export advisor for Victoria, one of his favourite things about working with clients is sharing their success. And he believes that no business is too small to celebrate. Whether a company is developing green technology in a warehouse or bottling sauce in a home kitchen, Jason is here to help share unique Victoria businesses with the world.

Export Navigator: Can you introduce yourself and your role as an export advisor?

Jason: I’m Jason Seed, the export advisor for the Victoria region. My central role is to help businesses grow either inter-provincially or internationally. I also see myself acting as a connector, making sure that the companies I work with know about the grants and services that are available to them. Since the Export Navigator program started as a rural initiative, we believed businesses in Victoria and other urban centres would already have a good handle on the available funding sources, government programs, and third-party business services that are out there. I’ve discovered that most companies need to be made aware of many of the initiatives that could help grow their business. So, I enjoy being able to connect businesses with the right resources. Of course, I also offer business advisory services, market planning, market entry and market research to businesses of all sizes.

Export Navigator: What kinds of businesses do you mainly work with?

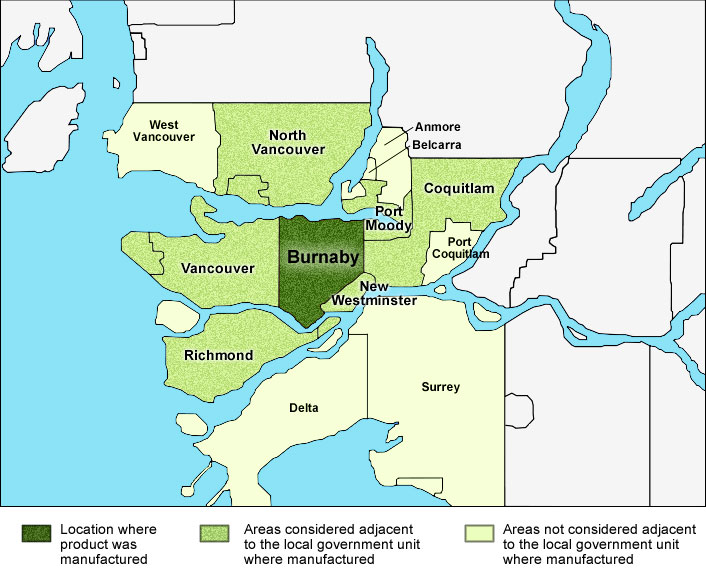

Jason: I work with a nice selection of life science companies and several companies working on clean technology or general information technology. I have a pretty good roster of agri-food companies as well. One category that surprised me was manufacturing. I was surprised to see all of the manufacturing going on in the Victoria area.

Export Navigator: What is your professional background, and what made you want to work as an export advisor?

Jason: I’ve done a lot of consulting over the years with agri-tech companies and tech companies in general, but the companies I work with here are quite a bit different from anything I’ve worked with in the past.

After building several successful companies across Canada and having kids at home, the travel got too difficult. I have always loved consulting, so when I saw the export advisor opening, I saw it as an opportunity to help businesses closer to home.

Export Navigator: What do you look for in a business to determine if they are ready to grow beyond B.C.?

Jason: I’d say only about a third of my clients fit into the category of companies that have yet to even think about exporting beyond B.C. In contrast, the rest of my clients are already exporting but need help with new markets or grants and funding, for example. When meeting new clients, I look closely for a sense of initiative or drive. I find that the most successful clients are communicative and responsive, and we end up having many back-and-forth conversations. The most eager clients are those who find success quite quickly. I respond well to energy and enthusiasm, so I enjoy working with companies that are excited as well.

Export Navigator: How would you describe your advising style/approach to working with clients?

Jason: I think of myself as a go-getter and advocate for my clients. I think it’s also essential to build awareness, especially among all the government agencies here. I prioritize getting the proper attention for clients ready to expand their business. But I’m not an expert on every program; if I don’t have the answer, I’ll find it for them. In many cases, that happens because I’m dealing with sectors and businesses I haven’t encountered before. But I’m quickly expanding my knowledge base and learning lots of new things along the way.

One other way I work is to connect clients with each other. I enjoy this greatly because I see what they’re doing and how they can benefit each other. I’ve had great feedback so far from clients that I’ve connected with other clients.

Export Navigator: Aside from being an export advisor, what else do you like to do in your free time?

Jason: I love to spend time with my kids. I promised my kids when they were young that whatever they were interested in, we would explore together. My daughter loves science, so we read Smithsonian encyclopedias about planets and the universe, dinosaurs, plants, rocks, and everything in between. My son also loves dinosaurs, especially ancient sea creatures; the meaner, the better.

Export Navigator: What’s your best advice for aspiring entrepreneurs?

Jason: We live in an exciting time right now where if you cobble together all the different programs and services available to a business, there’s a clear path from a startup to a successful multinational company. In the past, that would have been unheard of. I’d want businesses to know that you have an export advisor on your side to work with you on every step. There’s essentially a program or service for every step of the way, which is phenomenal.

Learn more

Thinking of exporting? Find an advisor in your region today and discover what opportunities are available to you.